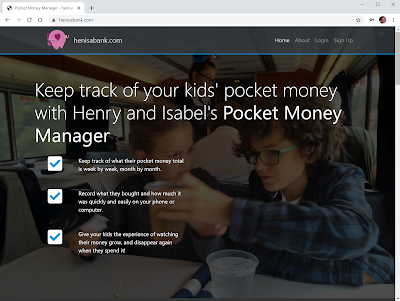

Pocket Money Manager

Exciting times!

Today we launch henisabank.com a pocket money manager website for both parents and children to manage their allowances.

My kids names are Henry and Isabel, so the name - henisabank.com is the first three letters of each of their names.

For years, when they were small, I'd mentally record how much each of their totals was - this was prone to error and doubt.

Later we moved to a Google Sheet solution - I made a simple spreadsheet with rows for each week (their basic allowance is their age, in Euros per week), and another column for recording what they purchased.

After he completed the amazing Khan Academy course in programming I thought a fun practical project would be to develop a real-live application with the boy.

Since I'm fairly generous with the pocket money, it comes up in day-to-day activities a fair amount - and figured it was a small enough project to complete in a few months.

The site uses a .net backend and was my first experience of a bootstrap html design - so I get to learn too!

I've pulled in a few webservices to manage SMS notification sending and currency conversions to whatever base currency is selected for the pocket money.

I'm hoping that most bases have been covered:

- Chore payments: That is one off increasing in the amount that the child has

- Regular payments: The weekly (or monthly) allowance increase

- Cash handouts: Record when a child is given some notes e.g. at an amusement park and they run off and spend

- On behalf purchases: When you buy something for the child either in a store (maybe as part of your normal shopping - which is hard to manage if they have money in a wallet also), and Online purchases that you make on your credit card on behalf the child

- Regular subscriptions: These days kids want mobile phones (and associated phone company contracts), or Netflix/Spotify subscriptions. They don't credit cards themselves; so you can setup regular deductions from their "bank account" on henisabank.com and pay it from your own credit card.

There are both Adult and Child accounts - so your child can login themselves and see how much they have (without troubling you) and also help manage the process by adding the text and amount of the transactions themselves - you just need to click "Accept" and the details are recorded.

Got Kids? Go ahead and try https://henisabank.com - all completely free.

Today we launch henisabank.com a pocket money manager website for both parents and children to manage their allowances.

My kids names are Henry and Isabel, so the name - henisabank.com is the first three letters of each of their names.

For years, when they were small, I'd mentally record how much each of their totals was - this was prone to error and doubt.

Later we moved to a Google Sheet solution - I made a simple spreadsheet with rows for each week (their basic allowance is their age, in Euros per week), and another column for recording what they purchased.

After he completed the amazing Khan Academy course in programming I thought a fun practical project would be to develop a real-live application with the boy.

Since I'm fairly generous with the pocket money, it comes up in day-to-day activities a fair amount - and figured it was a small enough project to complete in a few months.

The site uses a .net backend and was my first experience of a bootstrap html design - so I get to learn too!

I've pulled in a few webservices to manage SMS notification sending and currency conversions to whatever base currency is selected for the pocket money.

I'm hoping that most bases have been covered:

- Chore payments: That is one off increasing in the amount that the child has

- Regular payments: The weekly (or monthly) allowance increase

- Cash handouts: Record when a child is given some notes e.g. at an amusement park and they run off and spend

- On behalf purchases: When you buy something for the child either in a store (maybe as part of your normal shopping - which is hard to manage if they have money in a wallet also), and Online purchases that you make on your credit card on behalf the child

- Regular subscriptions: These days kids want mobile phones (and associated phone company contracts), or Netflix/Spotify subscriptions. They don't credit cards themselves; so you can setup regular deductions from their "bank account" on henisabank.com and pay it from your own credit card.

There are both Adult and Child accounts - so your child can login themselves and see how much they have (without troubling you) and also help manage the process by adding the text and amount of the transactions themselves - you just need to click "Accept" and the details are recorded.

Got Kids? Go ahead and try https://henisabank.com - all completely free.

Comments

Post a Comment